Bitwise suggests that Bitcoin's price could surpass $80,000 before the year ends. Key conditions include Donald Trump winning the U.S. elections, a 50 basis point rate reduction by the Federal Reserve, new economic incentives from China, and no significant turmoil within the cryptocurrency sector, as stated by Matt Hougan, the company's Chief Investment Officer, in an interview with The Block.

Hougan reiterated his predictions for the second half of 2023, identifying the approval of the Bitcoin ETF and the fourth half as key growth drivers.

In his final note, Hougan underlined that a win by Democratic candidate Kamala Harris could prevent this scenario from materializing. Democratic views on cryptocurrencies range from Senator Elizabeth Warren's 'anti-crypto army' to strong support from Congressman Richie Torres. “The problem over the last four years is that the former has influenced policy and agency appointments, creating a hostile environment for the industry,” Hougan said.

Hougan also emphasized that politicians need to “get out of the way” of Bitcoin: According to Hougan, if the Democrats have a majority in both houses of Parliament and Harris does not win, the party could adopt a more neutral stance towards the industry.

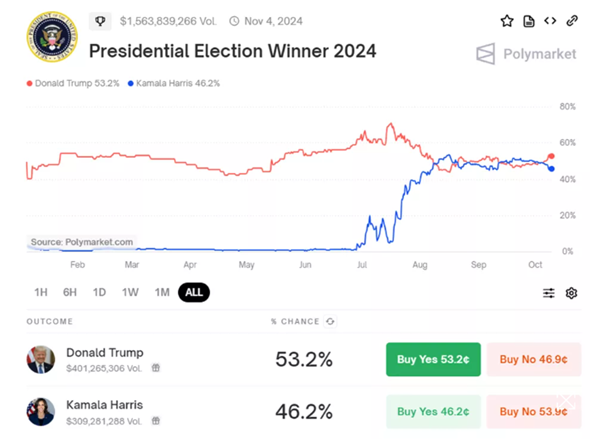

Polymarket, a forecasting platform, currently gives Democrats a 20% chance of taking full control of the legislature, compared to 33% for Republicans. Hougan added that the platform also gives Trump a 53% chance of winning.

Regarding potential surprises in the industry, Hougan clarified that these would include "hacks, major lawsuits, and significant token unlocks."

Hougan further expressed his confidence that Bitcoin’s rally does not require support from Ethereum, Solana, or newer altcoins like Sui, Aptos, and Monad. For a "full-scale surge" to $100,000 in just a few months, the entire market would need to embrace pro-crypto sentiments, he added.

In conclusion, Hougan remarked that Bitcoin has had a strong year so far due to its growing mainstream acceptance among politicians and increasing institutional adoption through ETFs.

“Regardless of what happens this year, Bitcoin’s price will aim for $80,000 and beyond in 2025,” he concluded.

Bernstein’s Position

Bernstein analysts also pointed to a potential rise in Bitcoin’s price to $80,000-90,000 if the Republican candidate wins the November 5th elections. A shift from Joe Biden to Harris, however, could lead to a pullback to $40,000, though the long-term positive outlook would remain intact, the analysts noted.

They confirmed their expectations, citing the largest divergence in Trump’s favor since Harris was officially named the Democratic candidate. The experts suggested that Bitcoin could trade sideways if Harris’ and Trump’s chances of winning become more balanced. However, the rally would gain strength if Trump maintains or expands his lead.

As for altcoins, sideways movement is expected until the election results are finalized. Market participants are seeking “more clarity regarding the next SEC chair,” Bernstein added.

Earlier reports indicated that a list of candidates for the SEC leadership role has surfaced in case of Trump’s victory. Meanwhile, Standard Chartered previously predicted a fivefold increase in Solana’s value if the former U.S. president returns to the White House.